iowa inheritance tax repeal

SF 110 Inheritance Tax Elimination LSB1785XS Analyst. In 2013 the Indiana legislature repealed their inheritance tax completely.

Recent Changes To Iowa Estate Planning 2022

The hope is to convince more retirees to choose Iowa as their state of.

. House File 841 passed out of subcommittee Monday afternoon. On Wednesday March 17 2021 the Iowa Senate passed 46 to 0 SF 576 a bill that repeals Iowas inheritance tax and state qualified use inheritance tax. The bill would not only eliminate the.

A bill for an act authorizing future tax contingencies reducing the state inheritance tax rates and providing for the future repeal of the state inheritance tax and state qualified use. By an 11-6 vote Wednesday the committee gave initial approval to Senate File 576 which makes two significant changes to Iowas tax code. An Iowa Senate subcommittee unanimously approved SSB 1026 that if passed would repeal Iowas inheritance tax and the states qualified use inheritance tax.

DES MOINES Iowa The Iowa Senate on Wednesday passed 46 to 0 SF 576 a bill that repeals Iowas inheritance tax and state qualified use inheritance tax. 619 a law which will phase out inheritance taxes at a. I dont think any state let alone the state of Iowa has any business of trying to extract social inequities through an inheritance tax.

On May 19th 2021 the Iowa Legislature similarly passed SF. 0-12500 has an Iowa inheritance tax rate of 5. Inheritance Tax Application for Extension of Time to File 60-027.

IA 706 Inheritance Tax Return. A Senate Ways and Means subcommittee voted 3-0 Tuesday to remove Iowa from a list of six remaining states that impose an inheritance tax. 25001-75500 has an Iowa inheritance tax rate of 7.

INHERITANCE TAX REPEAL. Partisan Bill Republican 1-0 Status. The phase-down begins with deaths occurring on or after July 1 2021 with the first of nine annual tax rate reductions.

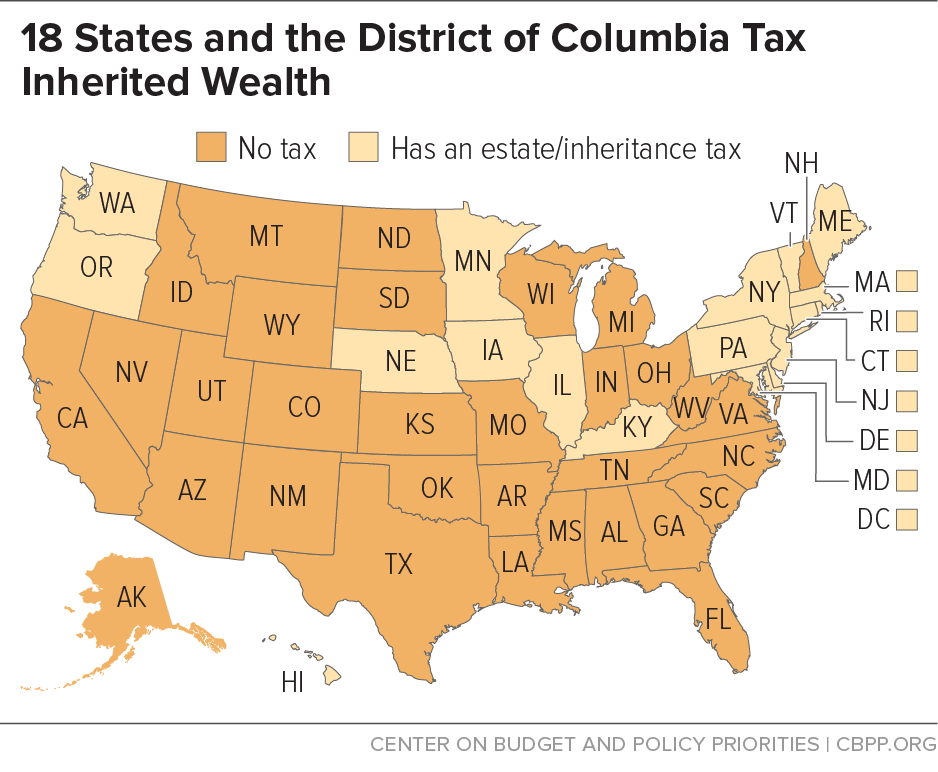

Read more about Inheritance Tax Application for Extension of Time to File 60-027. 12501-25000 has an Iowa inheritance tax rate of 6. The repeal of the Iowa inheritance tax follows the trend across the country to reduce such taxes.

Tax modernization is a focus of the current Nebraska Legislature and reforms to the 19th century-inspired inheritance tax need to be at the top of the list. The inheritance tax and the qualified use inheritance. Introduced - Dead 2021.

Dawson is leading the charge to repeal the tax. Bill introduction has ended for the 2021 Nebraska Legislature and two bills were filed to reform Nebraskas antiquated and increasingly uncommon inheritance tax. Iowa inheritance tax basics Spouses children grandchildren parents and grandparents all lineal descendants and ascendants pay no state tax on an inheritance no.

A bill for an act relating to the repeal of the state inheritance tax and the state qualified use inheritance tax. The bill would gradually raise the size of an estate exempted from the tax. The 25000 maximum would.

Jeff Robinson 5152814614 jeffrobinsonlegisiowagov Fiscal Note Version New Description Senate File 110 repeals.

Death And Taxes Nebraska S Inheritance Tax

Iowa Senate Panel Unanimously Approves Inheritance Tax Repeal Bill The Iowa Torch

Indiana Inheritance Tax Is Your Inheritance At Risk Indianapolis Estate Planning Attorneys

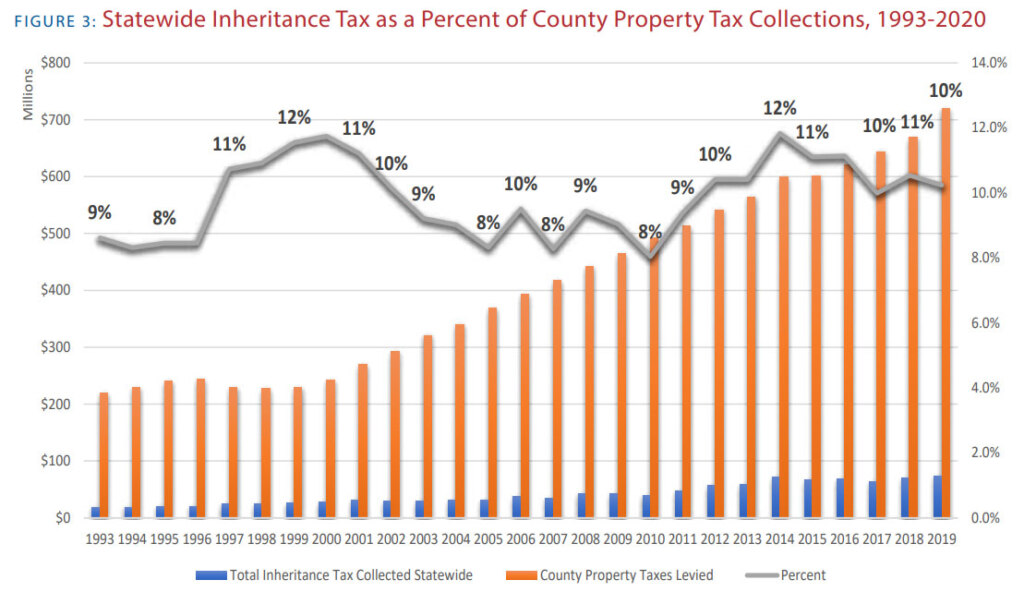

Iowa Budget And Tax Policy Reports

Senate Showtime Bills On Floor Include Repeal Of Inheritance Tax Campus Free Speech The Iowa Standard

2021 Iowa Legislative Session Ends With Flurry Of New Tax Rules

Death And Taxes Nebraska S Inheritance Tax

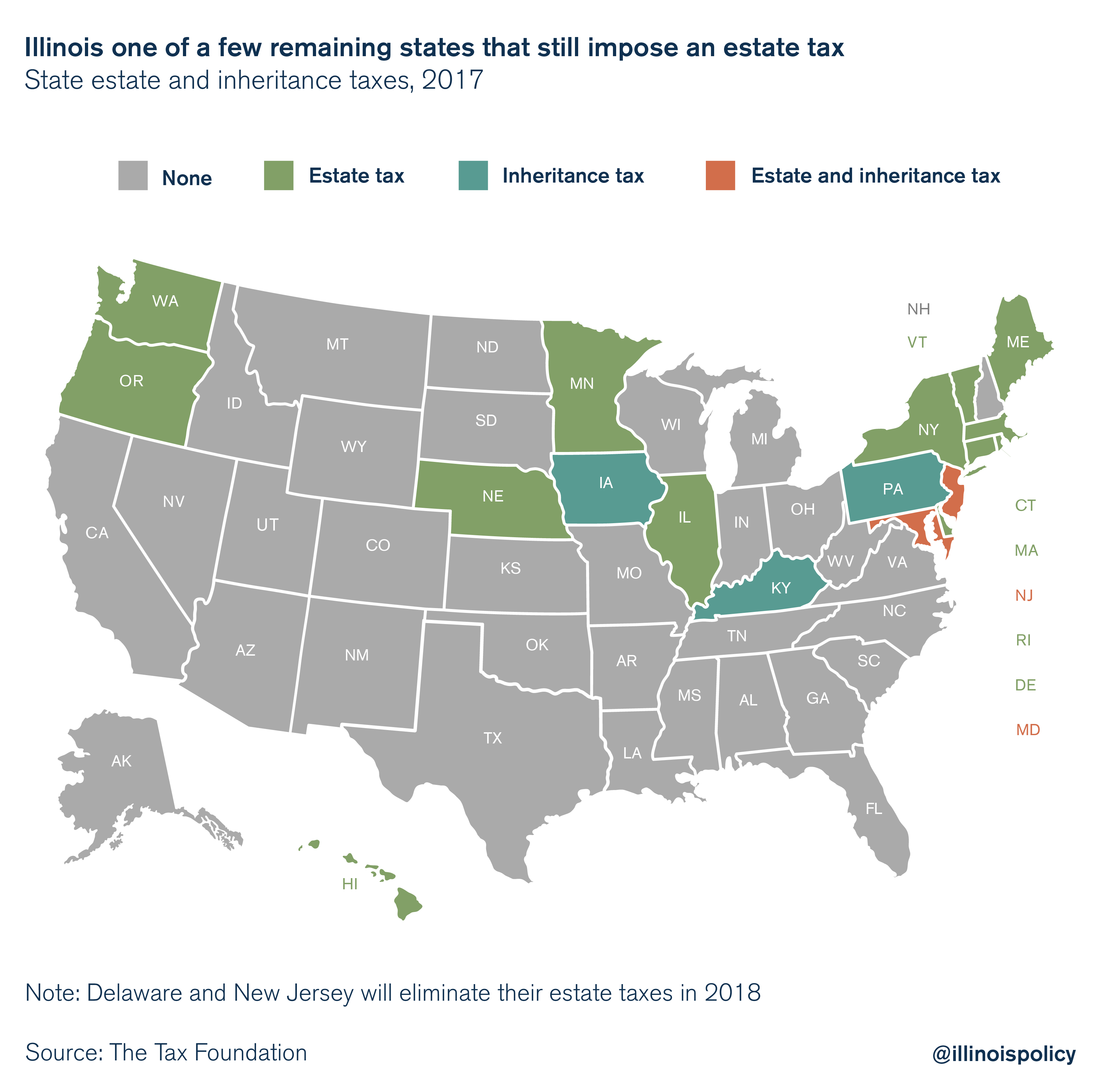

Estate Tax In The United States Wikipedia

Tax Talk Iowa S Inheritance Tax Gordon Fischer Law Firm

Iowa Estate Tax Everything You Need To Know Smartasset

Iowa Budget And Tax Policy Reports

Stepchildren Can Pay Taxes If They Inherit In Iowa Estate Tax Inheritance Estate Tax Inheritance Tax Estate Planning And Legacy Law Center Plc

Iowa Inheritance Tax Rate Schedule Fill Out Sign Online Dochub

As Other States Repeal Illinois Death Tax Remains

Another State Ditches Its Death Tax While Potential Backdoor Federal Estate Tax Looms

Iowa Budget And Tax Policy Reports

Elder Law West Des Moines Archives Beattymillerpc Com

State Estate Taxes A Key Tool For Broad Prosperity Center On Budget And Policy Priorities